Investment Approach

We are pioneering a trust-based investing process. We define “trust-based investing” as an investment philosophy and approach that reimagines the relationships between investors, investee partners, and communities to rebalance power.

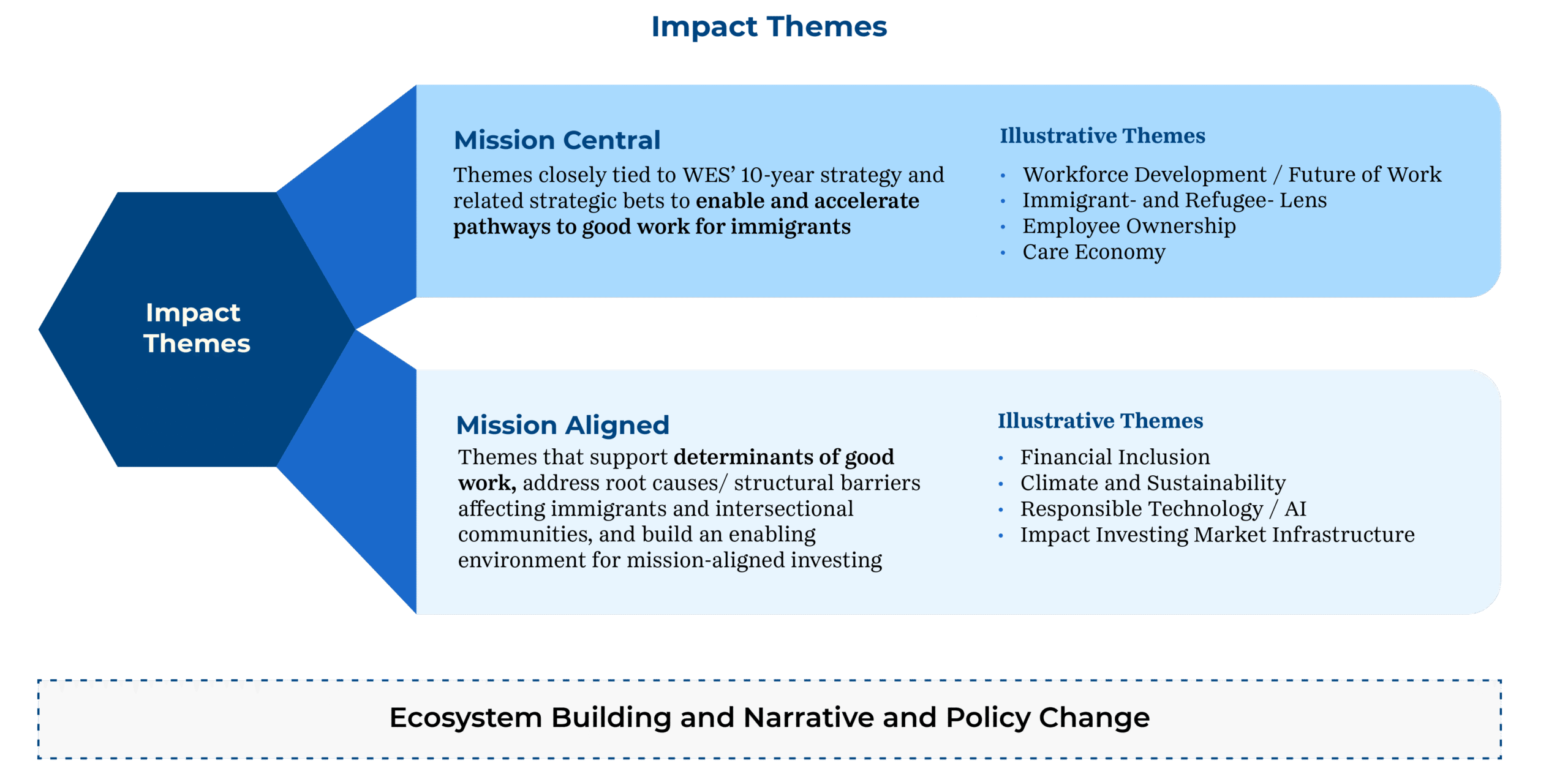

We also utilize an impact-first investment approach, screening opportunities based on alignment with WES’ mission, values, and two key categories of impact themes: Mission Central and Mission Aligned.

Across the portfolio, we support ecosystem-building initiatives, such as narrative and policy change efforts, and impact investing market infrastructure development. Finally, we seek to center principles of equity and inclusion across who, what, and how we invest.

Investment Parameters

WES invests across the spectrum of capital. As trust-based investors, we tailor our approach so prospective investee partners can access the right capital and terms to achieve their goals – whether they are demonstrating the viability of a new initiative, availing themselves of unexpected opportunities, investing in their people and operations, flourishing amidst uncertainty, or scaling their impact.

Two key strategies include Catalytic and Thematic Investing.

Catalytic Investing

WES’ Catalytic Investment Portfolio deploys patient, flexible, and risk-tolerant capital across the spectrum of financial returns. Our Catalytic Investments support markets and communities that have been historically overlooked and underinvested in, demonstrating new models and unlocking additional capital to achieve impact at scale. This includes early institutional capital, engaging in “family and friends” rounds that offer important signals to the market.

Thematic Investing

WES’ Thematic Investment Portfolio offers access to competitive sources of return for the organization while simultaneously driving impact aligned with WES’ impact, strategic growth goals, and mission-aligned themes. Thematic Investments are global and focus on more established fund managers and later-stage direct investments with strategic investment attributes.

| Catalytic | Thematic | ||

|---|---|---|---|

| Who | Target Communities | Back proximate leaders, who are best positioned to understand market gaps and design solutions. Often solutions support underinvested in and overlooked communities (e.g., immigrants, BIPOC, low-to-moderate income) | |

| Organization Type | Non-profit and for-profit entities | ||

| Where | Geographic Focus | U.S. and Canada, with select strategic global investments (e.g., India) | Global including North America, other developed markets, and emerging markets |

| What | Asset Classes | Innovative finance, private debt, venture capital, private equity, and real assets | Venture capital, private equity (e.g. buyout, growth equity), private credit, and real assets |

| Stage | Early-stage initiatives (e.g., emerging fund managers, demonstration projects, and early-stage ventures) | Established fund managers and underlying companies at any stage |

|

| How | Investment Types | Flexible, patient, and risk-tolerant capital, including: Fund investments Direct equity and debt Guarantees Recoverable grants Other innovative finance structures (e.g., blended finance, revenue-based finance) | Commercial investment opportunities and structures, including: Fund investments (primarily) Co-investments Direct equity and debt selectively aligned with strategic goals |

| Expected Return | Capital preservation, tracking long-term inflation | Competitive risk-adjusted returns |

|

| Investment Size | Typically, USD $250k to $1.5M | Typically, USD $1M to $7M |

|

Illustrative Diligence Criteria

| Stage | Diligence Category | Diligence Factor | Diligence Sub-Factors |

|---|---|---|---|

| Impact Diligence | Social Impact | Impact Alignment | Impact Themes, Impact Strategy, Impact Outcomes |

| Team | Team and Track Record | Track Record, Experience, Culture |

|

| Organizational Health | Equity and Inclusion | Diversity, Proximity, Integration, Acknowledgement |

|

| Portfolio Construction | Contribution to Portfolio and Learning | Portfolio Fit, Learning |

|

| Partnership | Strategic Partnership / Insight | Partnership, Insight |

|

| Investment Diligence | Investment Strategy and Differentiation | Investment Strategy | Strategy, Design (Centering Target Population), Pipeline |

| Differentiation and Competition | Differentiation, Competition, Fees |

||

| Market | Market Conditions and Outlook | Overall Positioning, Relative Positioning |

|

| Organizational Health | Systems and Infrastructure | Systems, Stability |