Impact Investing

The WES Mariam Assefa Fund believes that impact investing can play a critical role in catalyzing and scaling efforts toward more inclusive economies.

We invest in mission-driven leaders and organizations whose work is helping to ensure that all immigrants, refugees, and Black, Indigenous, and People of Color (BIPOC) in the United States and Canada can achieve their goals and thrive. Immigrants and refugees have intersectional identities, such as race and gender, which add nuance and complexity to the structural barriers they may face. We aim to center an intersectional equity lens in our investment approach in support of sustained and meaningful impact on people’s lives.

Our aim is to activate the full spectrum of catalytic capital to:

Drive capital to leaders and communities that have often been overlooked and under-invested in due to structural and systemic barriers.

Foster market-based, revenue-generating models that can achieve impact at scale. As a global non-profit social enterprise, WES offers first hand knowledge of how to grow an impact-first, self-sustaining organization.

Catalyze innovation and new markets, business models, products and services, financing structures, and more.

Leverage other capital and mobilize more resources towards meaningful impact.

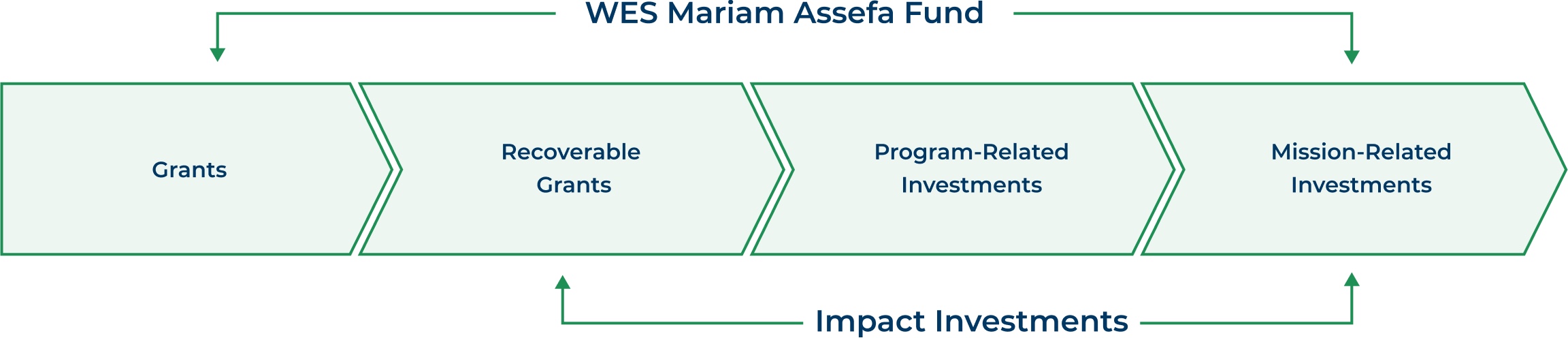

Spectrum of Catalytic Capital

We deploy flexible funding in the following ways:

Our Impact

Investing Priorities

To build more equitable and just economies, our impact investments unlock:

-

We seek to support proximate entrepreneurs and emerging fund managers with lived experience from immigrant, refugee, and BIPOC communities, often acting as the first institutional capital and disrupting traditional “family and friends” rounds.

-

To ensure that immigrants, refugees, and BIPOC can fully contribute their talents and advance in their careers, we must unlock equitable access to education, training, supportive services, and inclusive financing, as well as ensure that the skills and expertise these individuals offer are recognized and valued.

-

Our investments seek to ultimately shift power structures, dismantle systemic racism, and reimagine the building blocks of wealth to advance economic mobility for all.

Investment Parameters

We seek to ensure that mission-driven organizations have the flexible capital they need to demonstrate the viability of a new initiative, avail themselves of unexpected opportunities, invest in their people and operations, and flourish even amid uncertain conditions.

-

Organization Type

Non-profit and for-profit entities

-

Geographic Focus

U.S. and Canada

-

Target Population

Immigrants, refugees, and BIPOC

-

Investment Type(s)

- Direct equity and debt

- Fund investments

- Innovative finance (e.g., blended finance, revenue-based finance, income share agreements, shared ownership models)

- Guarantees and first loss capital

- Recoverable and field-building grants

-

Stage

Earlier stage organizations and concepts (e.g., Pre-seed to Series A, first time or emerging fund managers)

-

Expected Return

Catalytic, often concessionary, capital that puts impact first

-

Investment Size

Typically range from US$100,000 to $500,000

Investment Process

and Diligence Criteria

We are pioneering a trust-based, inclusive investing process, embedding Equity, Diversity, and Inclusion (EDI) principles in all aspects of our work. In an effort to address any power imbalance and information asymmetry, we seek to be transparent about our process. We meet innovators where they are and move quickly. On average, our due diligence process ranges from 30 to 60 days. We assess potential investments based on the criteria below:

Supporting Our Partners

The Fund is committed to developing long-term, trust-based relationships with our partners to deepen their impact. We holistically support our investee partners “beyond the check”. While we customize engagement with each investee partner, we typically offer strategic advice, connections to our network, capacity building, cohort convenings, strategic communications, help with hiring, follow-on funding opportunities, the full assets of the WES social enterprise, and more.

We also partner with organizations that are fostering collaboration, advancing research, and developing tools to create inclusive impact investing ecosystems.

Explore and learn more about the Fund’s investee and ecosystem partners below:

Connect With Us

We are excited to meet innovators and entrepreneurs who are reimagining the building blocks of wealth: education, employment, financial health, supportive services, and ownership.